Categories

Denver Housing MarketPublished September 2, 2025

Guide: Fixed-Rate vs. Adjustable-Rate Mortgages

Fixed-Rate vs. Adjustable-Rate Mortgages: A Friendly Guide for Denver Home Buyers

Shopping for a mortgage in Denver's competitive market? You're probably wondering whether to go with a fixed-rate or adjustable-rate mortgage (ARM). It's one of those decisions that can feel overwhelming, but here's the thing – there's no universally "right" choice. It all comes down to your situation, your plans, and how comfortable you are with a little uncertainty.

Let's break down both options so you can make the best decision for your Denver home buying journey.

What's a Fixed-Rate Mortgage?

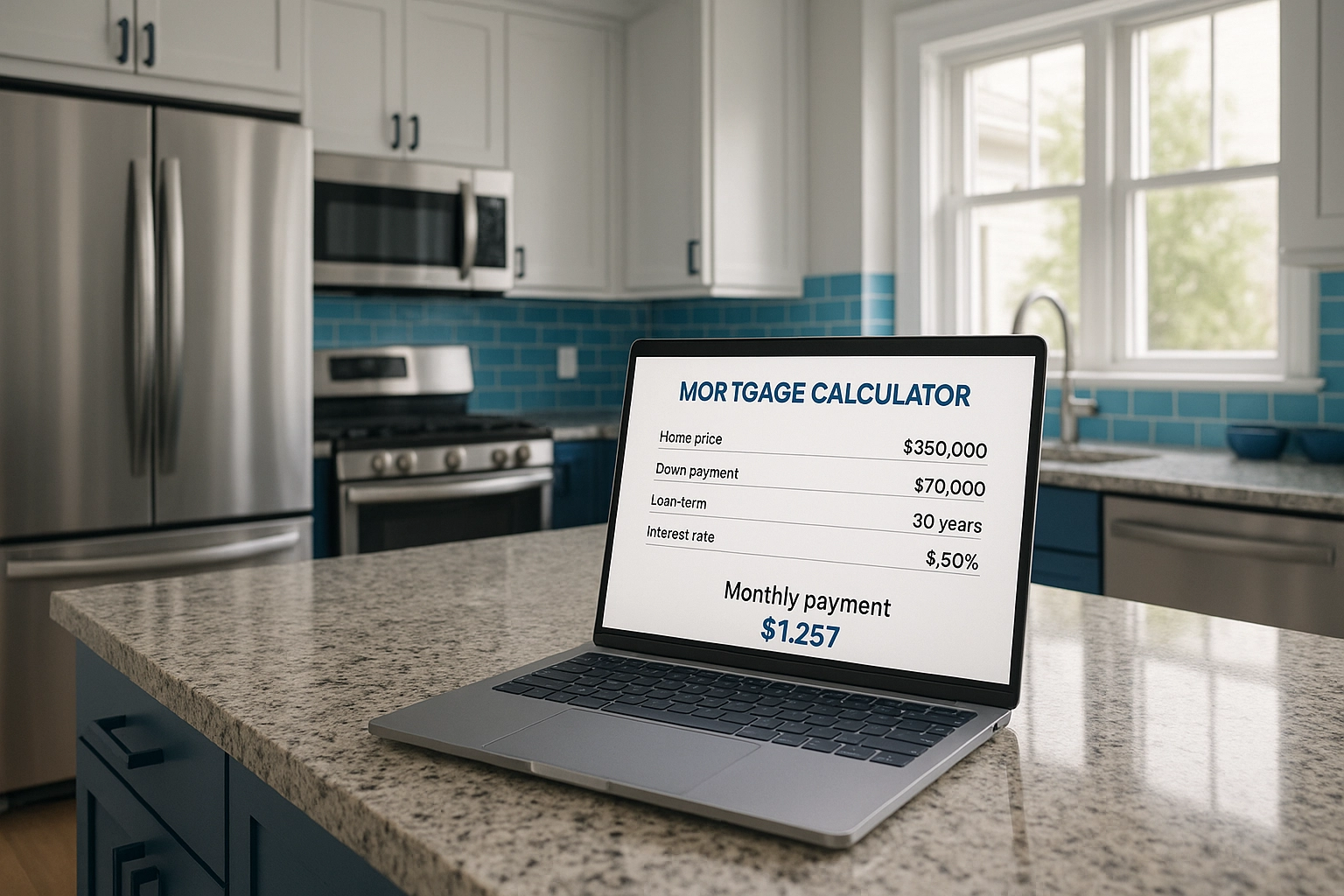

A fixed-rate mortgage is exactly what it sounds like – your interest rate stays locked in for the entire life of your loan. Whether you choose a 15-year or 30-year term (or something in between), that rate isn't budging. Your monthly principal and interest payment will be the same every single month until you pay off the loan.

The Pros of Fixed-Rate Mortgages

Predictability is king. You'll know exactly what your mortgage payment will be every month for the next 15 or 30 years. This makes budgeting a breeze and gives you peace of mind, especially in Denver where property taxes and insurance costs can fluctuate.

Protection from rising rates. If interest rates shoot up (and they can move fast), you're sitting pretty with your locked-in rate. While your neighbors might be dealing with higher payments, yours stays the same.

Easier to understand. No complicated adjustment periods, margin calculations, or index tracking. Your rate is your rate, period.

The Cons of Fixed-Rate Mortgages

Higher starting rates. Fixed-rate mortgages typically come with higher initial interest rates compared to ARMs. In today's market, that difference in monthly payments can be significant.

No benefit from falling rates. If rates drop dramatically, you won't see any savings unless you refinance – which comes with its own costs and hassles.

Less initial buying power. Higher monthly payments mean you might not qualify for as much house as you would with an ARM's lower starting payment.

What's an Adjustable-Rate Mortgage (ARM)?

An ARM starts with a fixed interest rate for a certain period (usually 3, 5, 7, or 10 years), then adjusts periodically based on market conditions. You'll often see them written as "5/1 ARM" – meaning 5 years fixed, then adjusting every year after that.

The Pros of ARMs

Lower starting rates mean lower payments. This is the big draw. ARMs typically offer interest rates that are 0.5% to 1% lower than fixed-rate mortgages during the initial period. In Denver's pricey market, this can translate to hundreds of dollars in monthly savings.

More buying power. Those lower payments can help you qualify for a larger loan, potentially opening up neighborhoods that might otherwise be out of reach.

Great for short-term owners. If you're planning to sell or refinance within the fixed period, you get all the benefits of the lower rate without worrying about adjustments.

The Cons of ARMs

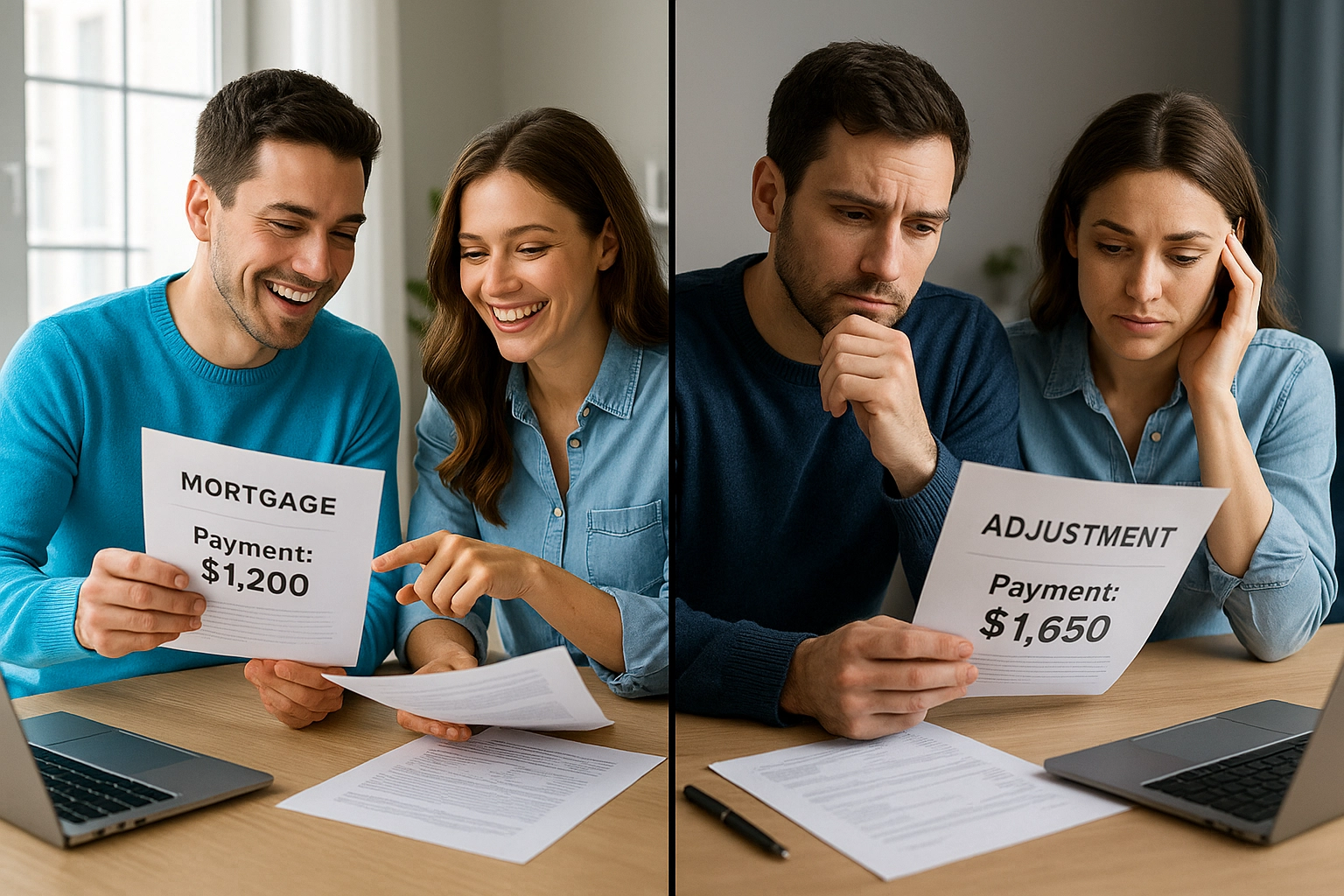

Payment uncertainty. After the fixed period ends, your rate (and payment) can go up. While there are caps on how much rates can increase, it's still uncertainty you'll need to budget for.

Complexity. ARMs come with terms like "margin," "index," and "adjustment caps." Understanding these details is crucial but can be confusing.

Potential for payment shock. If rates rise significantly when your ARM adjusts, you could face substantially higher monthly payments.

Denver-Specific Considerations

Denver's housing market has its own personality, and that affects which mortgage type might work best for you.

Market Trends in Denver

Denver's been a hot market for years, with home values generally trending upward. If you're buying in a competitive area like Capitol Hill, RiNo, or the Tech Center, every dollar in purchasing power counts. An ARM's lower initial rate might be the difference between getting the house you want and settling for your second choice.

Job Market Stability

Denver's diverse economy – from tech companies in the Denver Tech Center to aerospace in Centennial – provides relatively stable employment. If you're in a secure job with predictable income growth, you might be better positioned to handle potential ARM adjustments down the road.

Future Plans Matter

Are you buying your "forever home" in Stapleton, or is this a starter home in Glendale while you figure out which Denver neighborhood you love most? Your timeline significantly impacts which mortgage makes sense.

Making the Right Choice for Your Situation

Here's how to think through your decision:

Go with a fixed-rate mortgage if:

- You plan to stay in your Denver home for more than 7-10 years

- You value predictable payments over potentially lower initial costs

- You're stretching your budget and can't handle payment increases

- You're risk-averse and want to sleep well at night

Consider an ARM if:

- You're planning to move or refinance within 5-7 years

- You want maximum buying power in Denver's competitive market

- You can comfortably handle payment increases if rates rise

- You're confident about your income growth over the next several years

Questions to Ask Yourself

Before making your decision, consider these key questions:

How long do I plan to stay in this home? If it's less than the ARM's fixed period, you might never face an adjustment.

Can I afford higher payments if rates rise? Look at worst-case scenarios. What if your payment increased by $200-300 per month?

What are current rate trends? While no one can predict the future, understanding the current interest rate environment can inform your decision.

Am I using this as a stepping stone? Many Denver buyers start with condos or smaller homes, then trade up as their income grows. An ARM might make sense for a property you plan to outgrow.

The Bottom Line for Denver Buyers

In Denver's market, both fixed-rate and adjustable-rate mortgages can be smart choices – it just depends on your specific situation. The key is being honest about your plans, your risk tolerance, and your financial capacity.

Remember, you're not stuck with your choice forever. Many homeowners refinance when circumstances change, market conditions shift, or better opportunities arise.

Ready to Explore Your Mortgage Options?

Choosing between a fixed-rate and adjustable-rate mortgage doesn't have to be overwhelming. At Team United | United Real Estate Prestige Denver, we work with trusted local lenders who understand Denver's market inside and out.

Whether you're looking at your first home in Highlands Ranch, upgrading to something bigger in Cherry Creek, or investing in rental property in Five Points, we're here to help you navigate both the mortgage process and Denver's competitive real estate market.

Ready to start your Denver home buying journey? Reach out to our team today. We'll connect you with the right resources and help you make informed decisions every step of the way.

Your dream Denver home is waiting – let's find the mortgage that gets you there.